Margin expands your to buy energy, but inaddition it exposes one great exposure and you will probably big loss. Before beginning a brokerage account or getting an investing application, see whether choices change is offered among the money issues. Brokerage accounts are finest when you are seeking funding advice of a financial coach, nonetheless they is cover profits. Regardless of the economy price is, you’ll have the directly to find the home at that fixed speed as long as it is inside the specified schedule. You might want to purchase a made use of option if you feel industry speed to own a secured item will go off. If your price do slide underneath the hit rate, you could get it done the option to market their advantage during the large strike speed.

Tips for Hedging and Speculation Having fun with Alternatives

Possibilities trading can be one of more lucrative a method to trade in the fresh financial segments. Traders only have to establish a fairly few money for taking advantageous asset of the efficacy of choices to magnify their development, permitting them to proliferate their funds several times, have a tendency to in the weeks otherwise days. Vega means how much an option’s rate vary with a-1% improvement in the fresh designed volatility of the underlying inventory. Designed volatility steps simply how much industry thinks a secured item tend to fluctuate within the well worth later on. A top Vega mode the option changes inside really worth rapidly whenever volatility alter. Delta tips just how much the cost of an option is anticipated to go for every $step 1 improvement in the cost of the root stock.

Partnerships are not a recommendation on exactly how to purchase with one one company. Alternatives trade can appear advanced to start with, however with suitable suggestions, you might browse that it financial strategy effortlessly and then make told behavior inurl:”/go.php?url=” about your investment. But understand that easily purchased our home outright at the the first value of $two hundred,one hundred thousand, I’d eliminate $50,000 in case your family price fell to $150,100000. On the choice purchase, We only remove $ten,100, even if the home speed drops so you can $0. American possibilities will be worked out when until the conclusion time of the alternative, while Eu alternatives is only able to become worked out to the termination go out or perhaps the exercise time.

Choices creating rather than possibilities to shop for

In case your prevalent market value are less than the brand new struck rates from the expiry, the newest investor is also exercise the brand new lay. As long as they want to change its carrying ones shares, they may buy them to the open-market. To possess an ideas consumer (holder), the risk are contained on the number of the new superior paid. Such as, when selling an exposed call solution, the potential losings is actually unlimited, since there is zero restrict about how precisely large a stock price can be go up. Options are financial contracts that provide the new owner the ability to get otherwise sell an economic tool at the a particular speed for a particular time period. Choices are readily available for several borrowing products, such as stocks, money, commodities, and you will indexes.

Options Hit Rates Periods To own Awesome List

If you buy an options package, they offers you the correct yet not the responsibility to find otherwise sell an underlying advantage in the a flat rates to your or ahead of a certain time. The majority of the day, owners choose to get their earnings by the change out (closing out) its position. Consequently alternative owners promote their options in the market, and you can editors buy the ranks to personal. Regarding valuing alternative agreements, it is basically exactly about deciding the number of choices away from future rates events.

Less than that it, you get you to definitely all the way down hit phone call, offer a couple of at the-the-currency phone calls, and purchase one highest strike call (or even the exact same settings using sets). The goal is to make the most of minimal way on the root resource around the center hit rate. It involves at the same time to find a trip solution and an used alternative with the exact same hit price and you can conclusion date on a single advantage. Just like security options, phone calls and you can puts for the indexes and you may exchange-traded money (ETFs) can be used to imagine to your directional moves.

Options will likely be on the acquisition of an investment (phone call alternative) and/or selling of a financial investment (place choice). Possibilities can be joint to produce a selection of procedures many different potential consequences. In this case, the new individual can find a made use of with a strike equivalent to the present day market value and sell an extra lay from the strike speed 10% less than the modern market price. The option premium obtained regarding the 2nd lay will help offset the price of the strategy. The complete costs will likely be after that smaller, or completely neutralized, because of the offering a call alternative and the put spread. Keep in mind, from the offering a trip choice, the strategy tend to currently have a threshold on the potential gains.

Deal Size

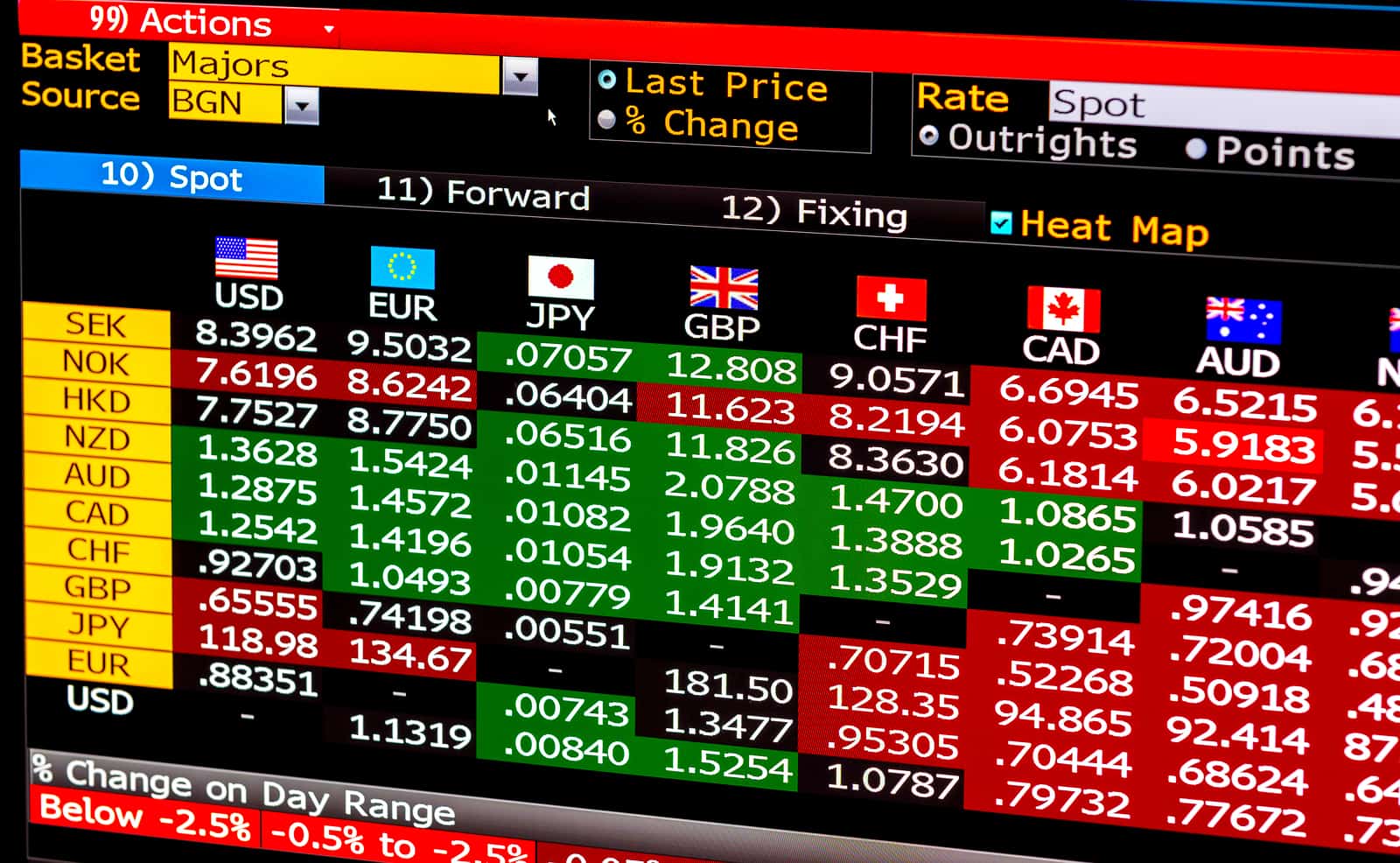

Choices can also be fit a preexisting inventory collection giving a professional hedge facing bad motions in the industry. To find the choices available for a certain inventory, you will need to make reference to a choice chain. A choice chain, also known as a choice matrix , reveals the listed sets, phone calls, their expiration, struck rates, and regularity and you may cost suggestions. The latter is known as a great “writer” from choices, and it has a duty to your client. Options both feel big price shifts to their past day of trading, but many only go to zero. “The huge benefits have you been makes somewhat more income for the investing the newest short term,” Moyers says.